Most auto finance companies’ total asset is closely related to the shareholder manufacturers' auto sales. As the domestic auto sales grows steadily, Fitch Bohua estimates that AFCs total asset may have exceeded CNY 1 trillion for the first time by end-2021 and may increase to CNY 1.16 trillion by end-2022. Domestic AFCs’ market share has been increasing consistently and will benefit from the rapid growth of electric vehicle sales. AFCs’ overall financing structure has a high proportion of short-term funding. Consequently, their financing costs are affected by the fluctuation of market short-term interest rates, which directly affects their profitability. Monetary policy is expected to remain accommodative in 1H22, which will help AFCs reduce their financing costs and improve their profitability marginally.

Note: This report was prepared in Chinese. The English version is for reference only. In the event of any inconsistency between the two versions, the Chinese version shall prevail.

AFCs Total Asset Closely Related to Shareholder Auto Sales, Industry Asset Exceeded CNY 1 Trillion

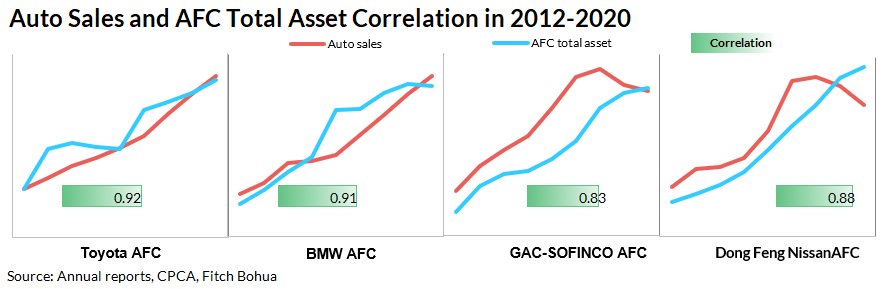

Most auto finance companies (AFCs) exclusively provide financing products to the auto consumers of the shareholder manufacturers, so shareholder auto sales have a significant impact on AFCs’ business volume and asset size. Based on the relationship between AFCs and shareholder vehicle sales, we selected four AFCs with long operating history and reliable public information for assessment, including vehicle sales, AFC retail contracts and AFC asset size. The results show that the correlation coefficient between AFC's asset size and the sales of the auto brands it serves reaches 0.9 during 2012-2020. A similar correlation also exists between AFC’s retail contracts and auto sales.

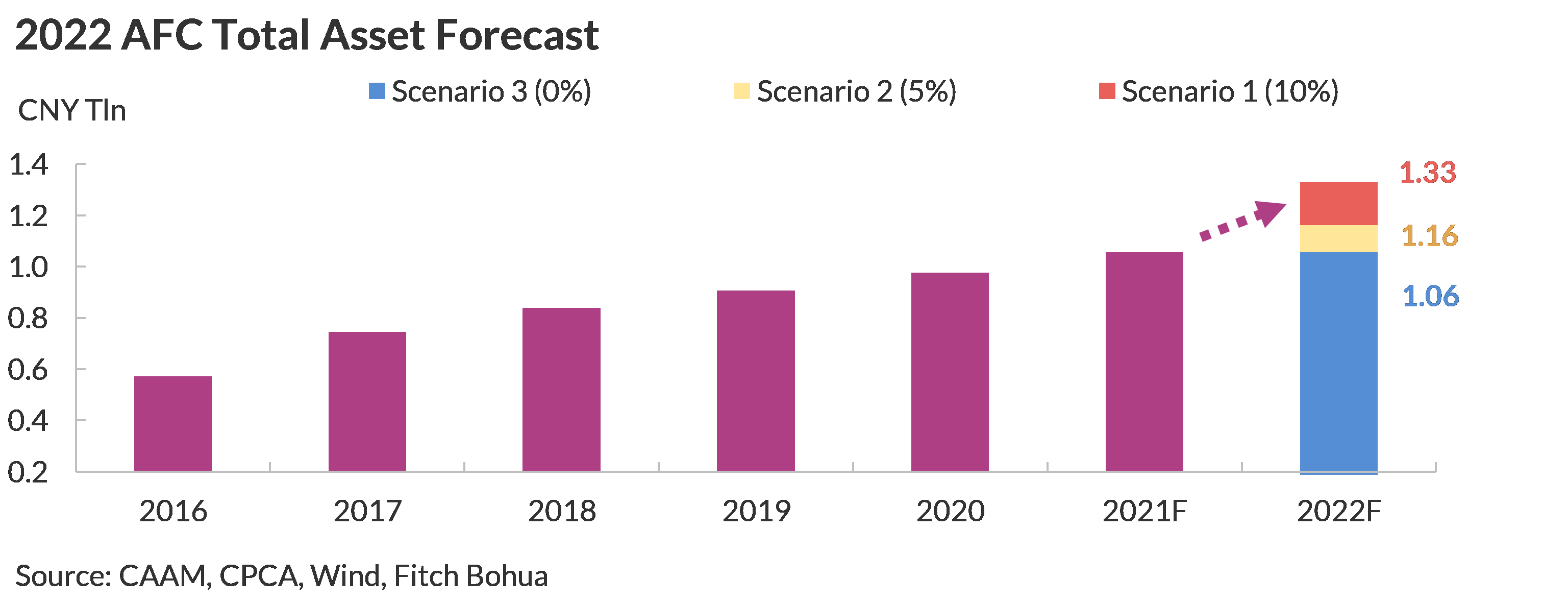

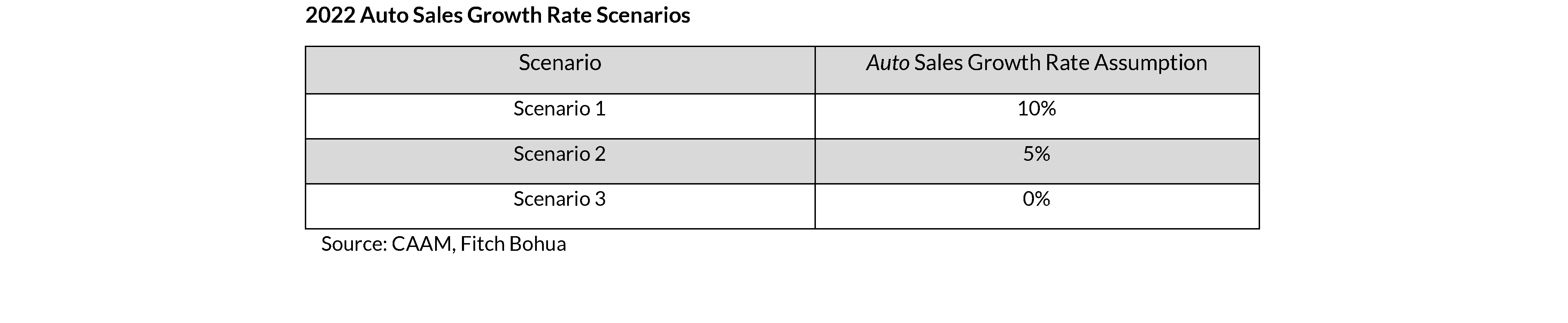

Based on the correlation between auto sales and AFCs’ total asset, Fitch Bohua expects the total asset of 25 AFCs may have exceeded CNY 1 trillion for the first time by end-2021. Similarly, we conducted a scenario analysis of total asset in 2022 (see Appendix), referencing the growth rate and forecast of auto sales released by China Association of Automobile Manufacturers (CAAM).

Scenario 2 is the base case for our forecast, assuming a 5% growth rate in auto sales in 2022, close to the 5.4% growth forecast by CAAM. Based on this assumption, our results show the total asset of 25 AFCs will reach CNY 1.16 trillion by end-2022, which is largely consistent with the asset growth rate since 2017.

Domestic AFCs’ Market Share Increases, Benefiting from Rapid Growth of Electric Vehicle Sales

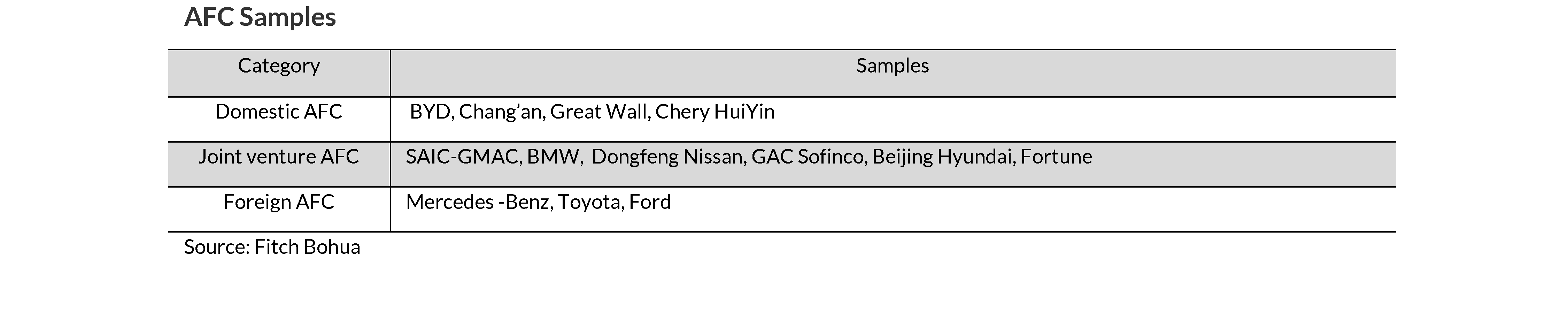

To analyze the changing landscape of the AFC industry, we have examined the auto brands/manufacturers served by each AFC and categorized them according to the nature of their shareholders.

• Joint venture AFC: shareholders include both domestic shareholders and foreign shareholders.

• Foreign AFC: 100% ownership by foreign shareholders.

• Domestic AFC: 100% ownership by domestic shareholders.

Domestic AFCs’ Market Share Growth Maintains Momentum

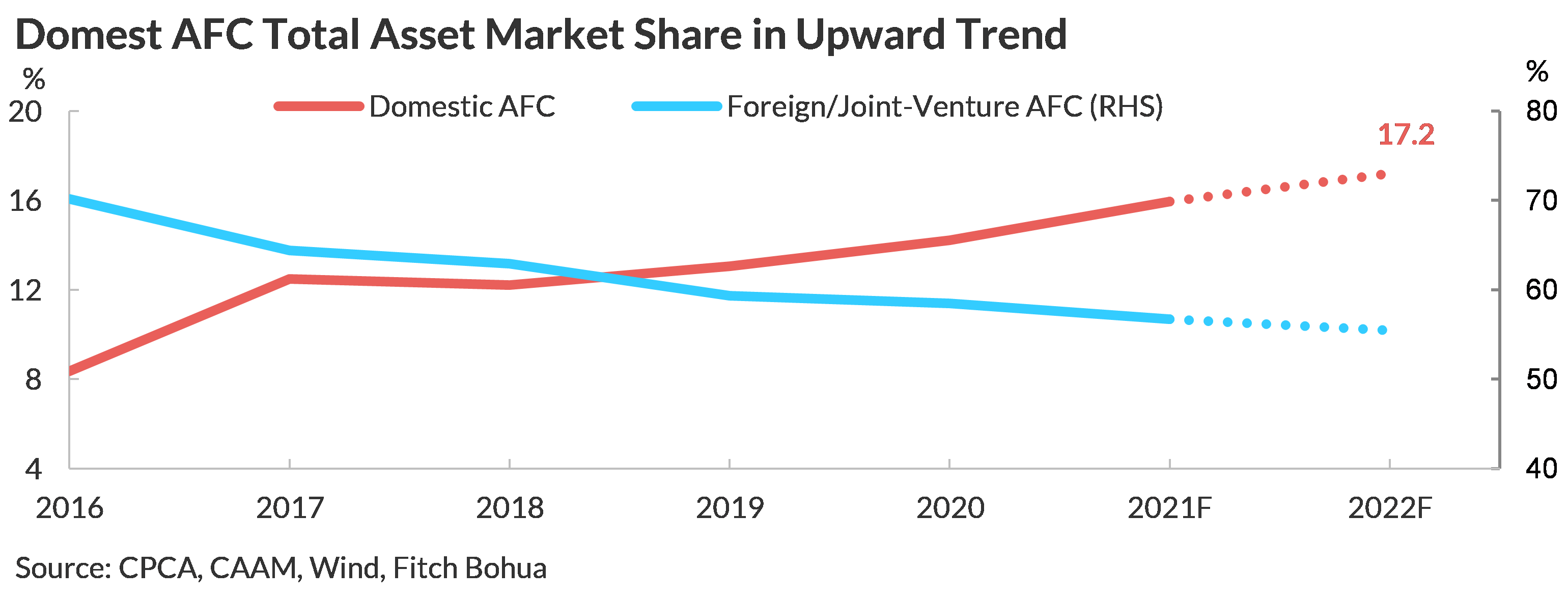

As the total asset of the AFC industry keeps growing year by year, the market position of each AFC category has changed significantly. Statistics indicate that the market share of domestic AFCs, measured by asset size, has maintained a steady growth trend since 2016. Due to the auto sales decline in 2018, domestic AFCs experienced a brief decrease in market share, but then regained their upward momentum. Fitch Bohua believes that the increasing market share of domestic companies has been attributed to the aggressive expansion by top branded vehicles in terms of brand upgrade, intelligence and electrification strategies. (See Fitch Bohua Sector Outlook 2021: Automotive Manufacturers)

Fitch Bohua expects domestic AFCs’ market share to reach 17.2% by end-2022, an increase of 8.9 percentage from end-2016, assuming auto sales grow by 5% in 2022 (Scenario 2) and electric vehicle sales reach CAAM's forecast of 5 million units.

Domestic AFCs and Several Joint Venture AFCs May Benefit from Rapid Growth in Electric Vehicle Sales

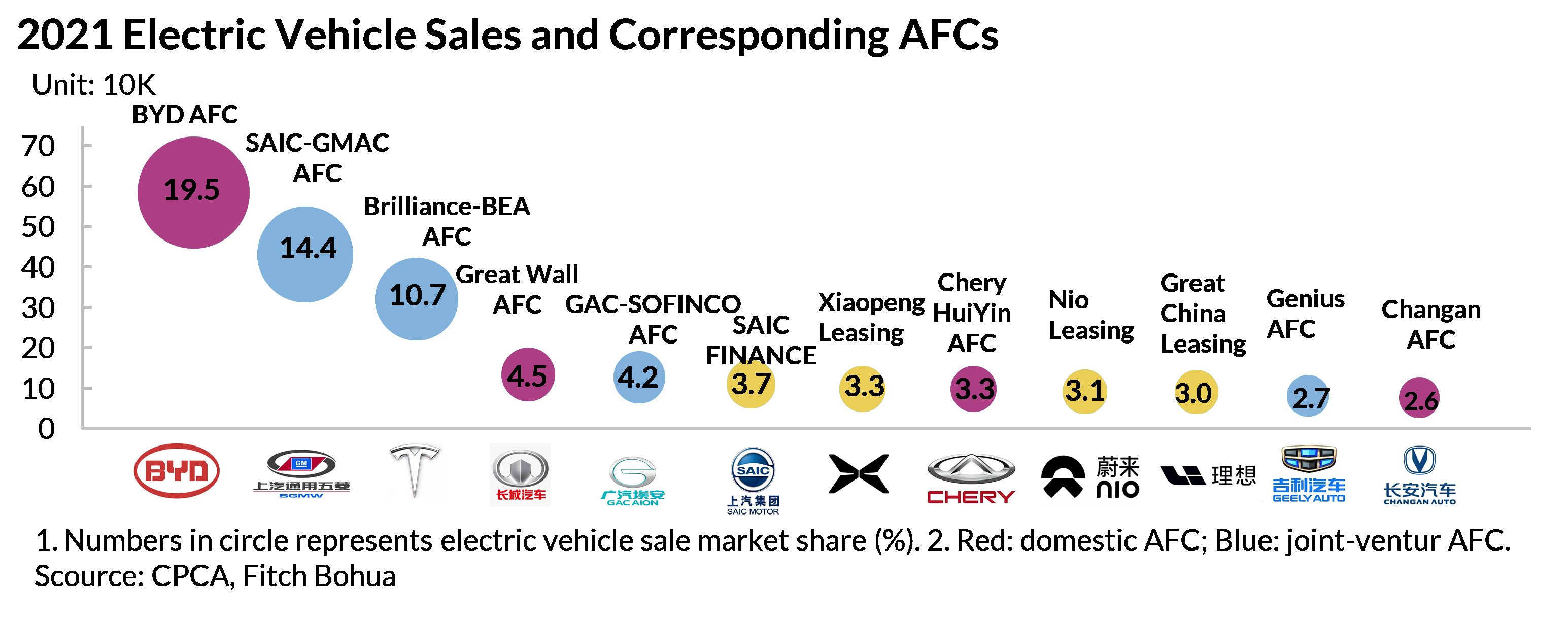

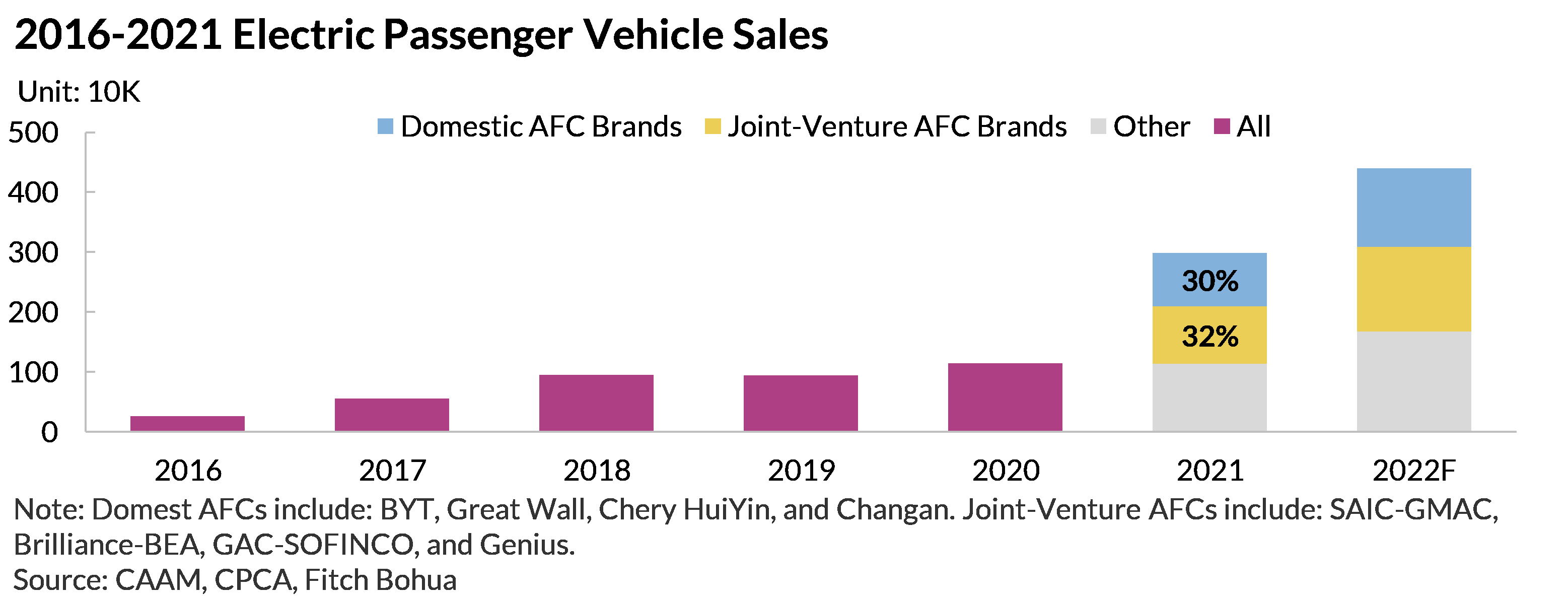

According to the China Passenger Car Association (CPCA), electric passenger vehicle sales rose sharply in 2021, with cumulative retail sales reaching 2.99 million units, up 169% year-on-year. Among them, electric vehicles account for 39% of Chinese brand sales, whereas only 3.3% of major joint venture brands sales are electric vehicles. Domestic brands dominated the 2021 top electric vehicle sales league, except Tesla.

The four domestic AFCs accounted for only 15.9% of the 25 AFCs in terms of asset size by end-2021. However, the growth rate of auto sales related to these AFCs reached 28.6%, which was significantly higher than the 3.8% of China auto sale growth rate in 2021. Moreover, electric passenger vehicle sales by the domestic automakers was about 30% in 2021, which may help boost the market share of their subsidiary AFCs. In addition, several joint venture AFCs also benefit from the rapid growth of electric passenger vehicles, with their corresponding automakers having an electric vehicle market share of 32% in 2021.

CPCA estimates that electric passenger cars will maintain rapid growth momentum in 2022, with a penetration rate of 25%, up 10.2 percentage from 14.8% in 2021. The significant growth in electric vehicle sales will raise the market share of local manufacturers and related AFCs. Fitch Bohua forecasts that under the benchmark scenario (Scenario 2), domestic AFCs’ market share will reach 17.2% by end-2022.

China’s new car makers, represented by Nio, Xpeng and Li Auto, achieved extraordinary sales growth in 2021. However, due to their low base, they collectively sold 280,000 units in 2021, accounting for 9.4% of the electric vehicle market. In addition, the above-mentioned car companies provide financing support to their retail customers mainly through their leasing companies or commercial banks. Therefore, these new car makers have limited impact on the asset size and industry landscape of auto finance companies in the short term.

Short-Term Financing Cost Volatility Affects AFCs’ Profitability; Positive Monetary Policy Enhances Net Interest Spread Slightly

High Reliance on Short-Term Funding; Short-Term Interest Rates Drives Interest-Bearing Liabilities Cost

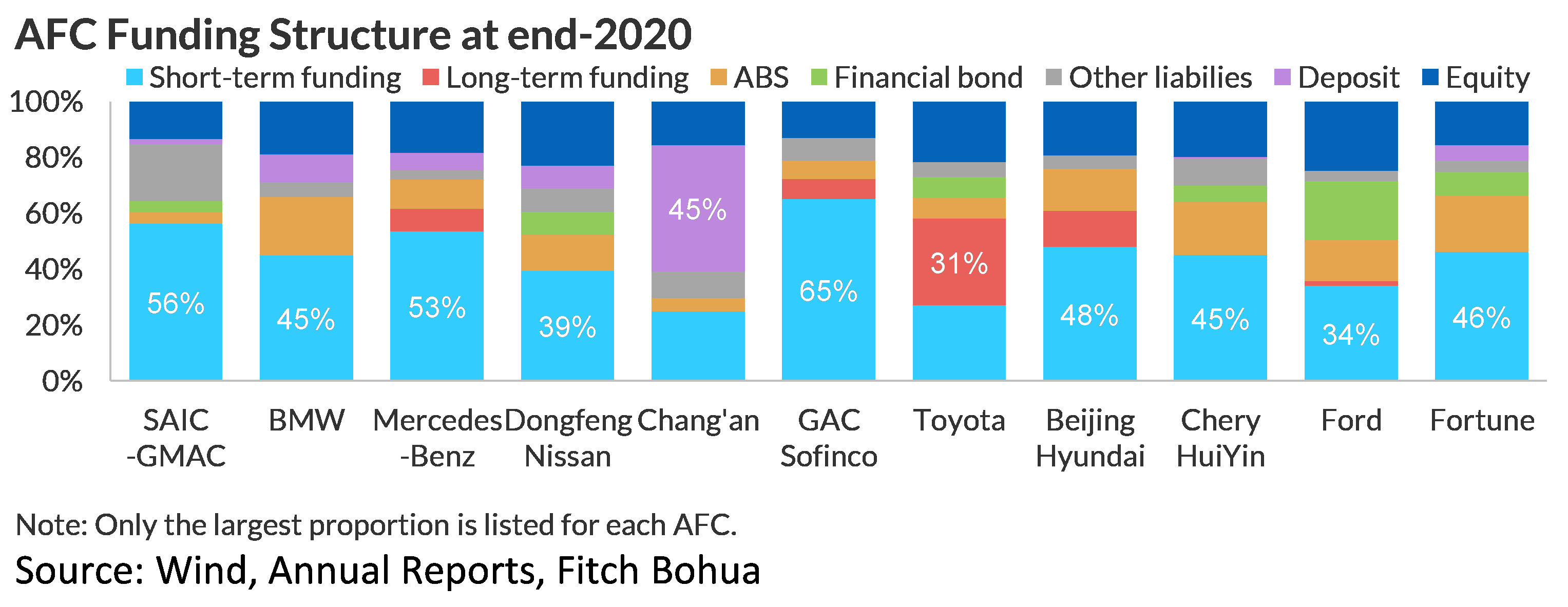

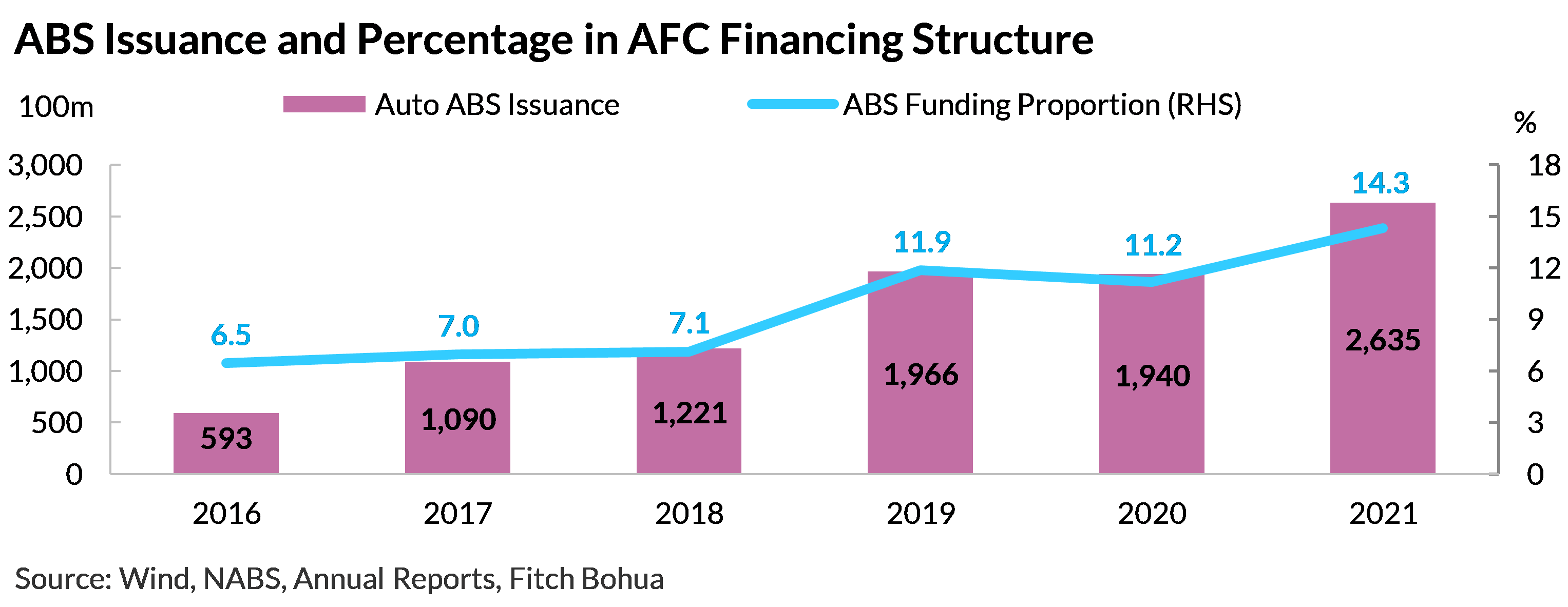

The funding structure of AFCs relies heavily on short-term funding, which accounted for 45.2% of the total funding at end-2020, based on 11 sample AFCs . The funding structure was basically consistent with that at end-2019. Long-term financings include long-term funding, ABS, financial bonds, shareholders' deposits and equity, each representing 3.8%, 11.2%, 3.5%, 7.3% and 17.8% of the total financing, respectively.

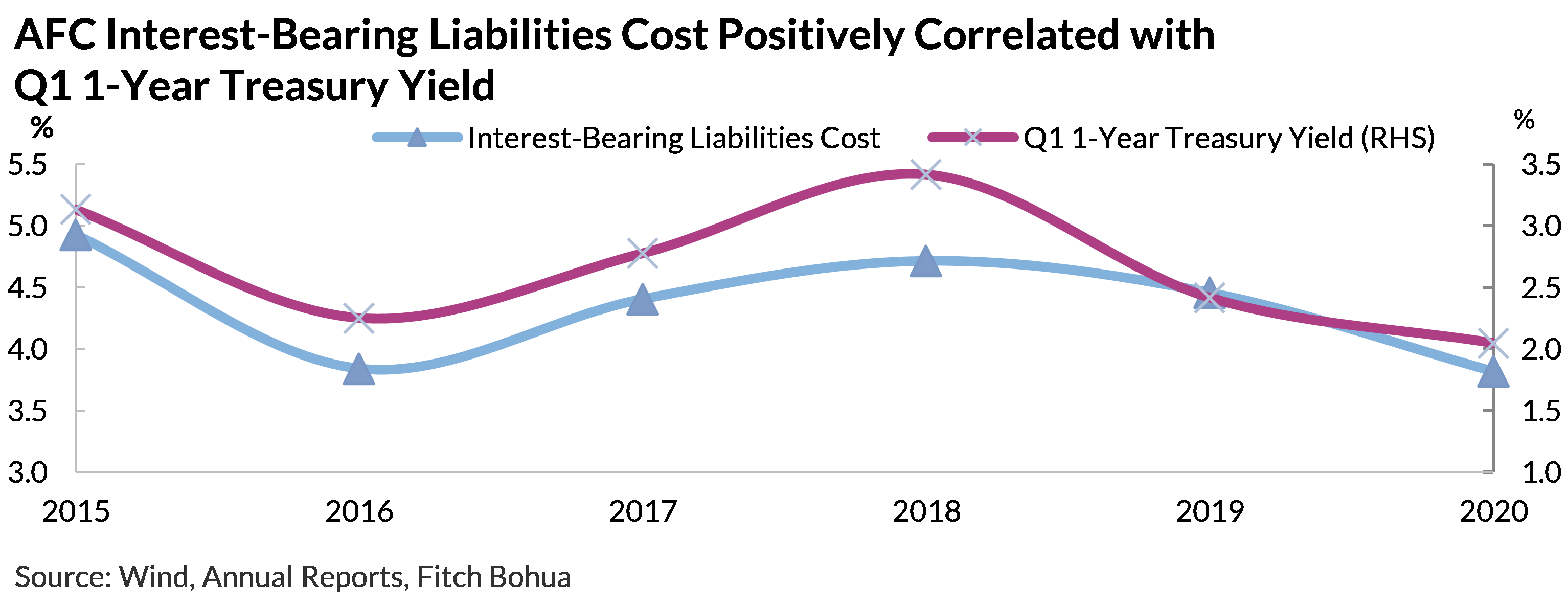

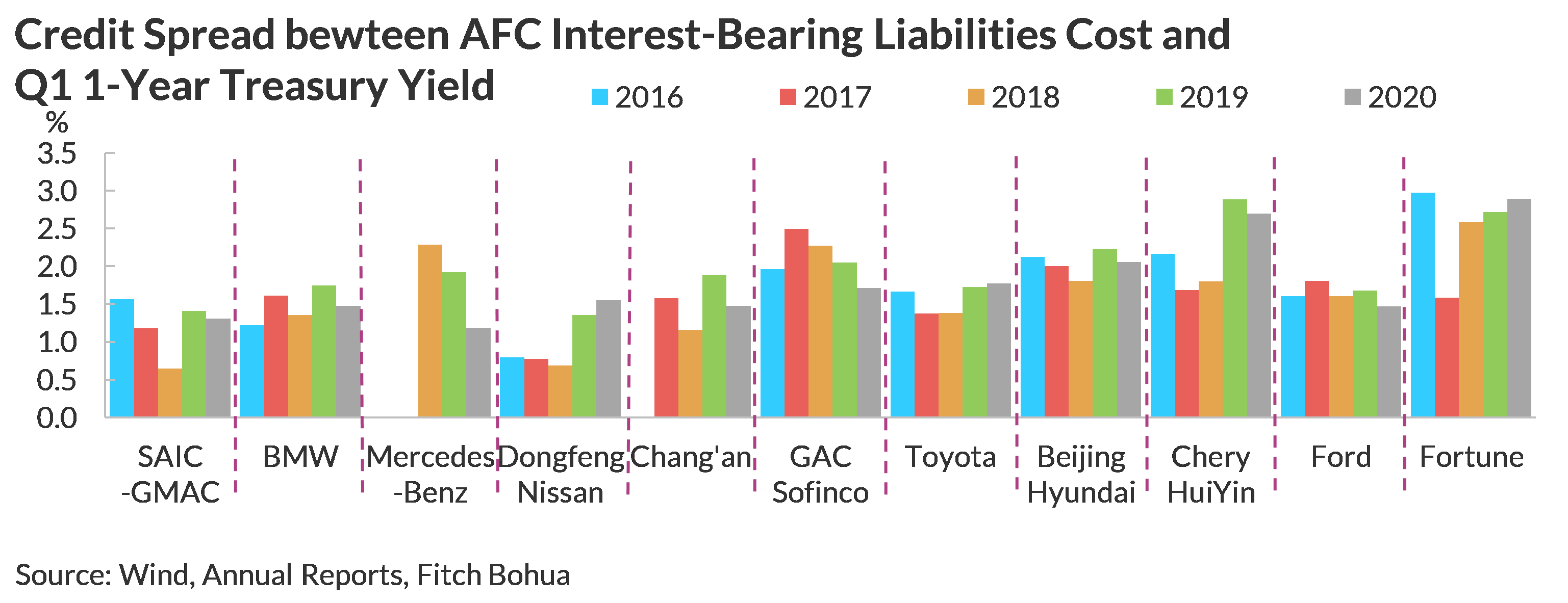

AFCs’ financing cost is sensitive to short-term interest rate fluctuations, since they rely largely on short-term funding. All AFCs financing costs share a similar trend during 2012-2019 and the cost is positively correlated with the Treasury yield. The correlation is especially prominent when compared with the Q1 1-year Treasury yield. (See Low Growth of AFC Intensifies Industry Competition; Domestic AFCs Expand in Lower-Tier Markets)

Interest-Earning Assets Yield Moves Downward; Interest-Bearing Liabilities Cost Affects Net Interest Spread

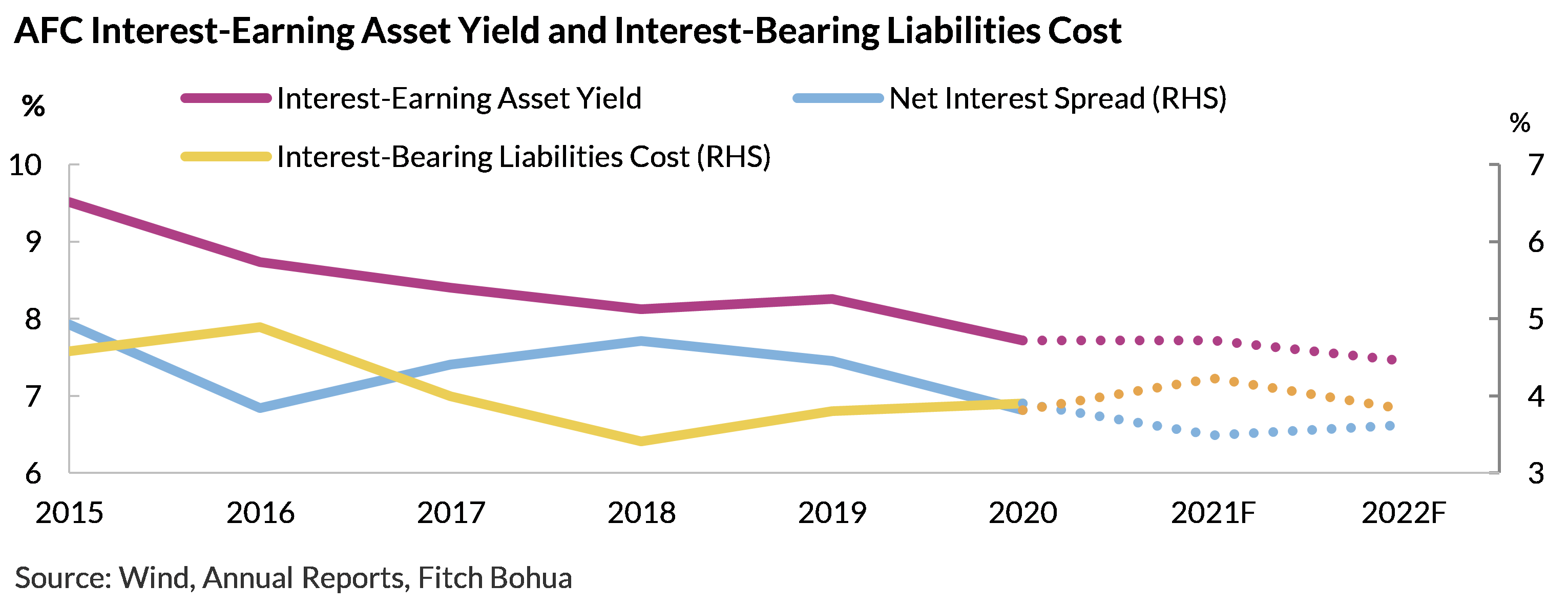

Net interest spread is an important indicator for evaluating AFCs’ profitability and is determined by both interest-earning asset yield and interest-bearing liability cost. On the one hand, the interest-earning asset yield decreases from 9.5% in 2015 to 7.7% in 2020, due to increased competition in the auto market. Such a decrease drags down the yield on AFCs’ asset side. Fitch Bohua believes that the asset-side yield is prone to fall but not rise, against the backdrop of single-digit growth in auto sales and a downward trend in the 1-year Loan Prime Rate (LPR).

On the other hand, AFCs’ interest-bearing liabilities exhibits large fluctuations, which introduces heightened uncertainty on profitability. This impact is mainly due to the high proportion of short-term borrowings in the financing structure, and AFCs’ financing cost is significantly affected by short-term interest rates. For instance, 1-year Treasury yields declined significantly year-over-year in the first quarter of 2016, 2019 and 2020, driving down AFCs’ short-term financing costs. Correspondingly, AFCs’ net interest spread rose by 30.9bp, 39.0bp and 10.1bp. In response to the epidemic shock of 1H20, the regulatory authorities implemented expansionary monetary policies and the financing cost generally declined; however, the asset-side yield moved down on a large scale as the one-year LPR was lowered by 30bp. Therefore, the increase in net interest spread was dampened throughout the year. One-year treasury yield rose 52.6bp and 64.1bp year-on-year in 1Q17 and 1Q18, resulting in elevated financing costs and a decrease in net interest spread of 89.6bp and 58.4bp, respectively. Fitch Bohua estimates that AFCs’ financing cost has increased by 41.1bp to 4.23% in 2021 compared to 2020, due to higher short-term interest rates in 1Q21.

The monetary policy may be supportive in 1H22, which is beneficial for AFCs to reduce financing costs. The central bank has cut the 1-year LPR by 15 bps and the reverse repo and Medium-term Lending Facility (MLF) rates by 10 bps since December 2021; consequently, the 1-year Treasury yield has dropped from 2.57% in early December 2021 to 1.94% in February 2022. Our estimation indicates that the downward movement of short-term interest rates may help lower AFCs’ interest-bearing liabilities cost by 40bp to 3.83% in 2022, which is close to the level of the same period in 2020. Meanwhile, the 1-year LPR cut will bring AFCs’ asset-side yield down by 26.9bp in 2022. Accordingly, AFCs’ net interest spread may improve slightly to 3.62% in 2022 compared with 2021.

Significant Differences in Financing Structures across AFCs

The financing structure of AFCs varies. Fitch Bohua believes that the financing structure difference reflects each AFC’s trade-off between financing stability and financing cost. AFCs with higher credit profiles will have much flexibility in adjusting their financing structures. Such AFCs can enhance financing stability by increasing the proportion of long-term funding such as long-term loans and financial bonds; they can reduce financing costs by increasing the percentage of short-term funding and asset-backed securities (ABS), when the financing environment is more supportive. On the contrary, AFCs with lower credit profiles may prefer to reduce financing costs through short-term funding and ABS issuance, due to the higher cost of long-term loans or financial bond issuances.

Record ABS Issuance in 2021, Boosting Its Share in The Financing Structure

AFCs’ asset quality has shown resilience against the COVID-19 outbreak in 2020. Thanks to AFCs’ larger provisions and diversified customer concentration, the AFC industry NPL ratio stood at 0.49% at end-2020, down slightly by 0.01% from 2019. Meanwhile, the industry's provision coverage ratio reached 535.9%, up 87.3% from 2019.

The Fitch Bohua Auto Loan ABS Index shows a stable trend for the underlying assets in 2021. The M2 overdue rate remained at a low level. As of 3Q21, the M2 and M3 overdue rates were 0.08% and 0.04%, respectively, unchanged from previous years. (See Interbank Market Auto Loan ABS Index 3Q21). Fitch Bohua expects AFCs’ asset quality to remain stable as auto sales steadily rebound in 2022.

Stable underlying asset performance, low customer concentration, and growing market size have boosted the market acceptance of auto loan ABS. The auto-ABS issuance hit a new record high in 2021, reaching to CNY 263.5 billion. Fitch Bohua expects auto-ABS to account for 14.3% of AFCs' financing structure by end-2021, up from 11.2% at end-2020. As a long-term financing option, ABS will help AFCs improve their financing structure by reducing their reliance on short-term borrowings. It is expected that ABS issuance by AFCs will continue its upward trend in 2022 under a relatively accommodative financing environment. Therefore, the share of ABS in AFCs’ financing is likely to increase further.

Appendix: AFC Classification and Forecast Assumptions

1. AFC Classification and Samples

AFCs are categorized to facilitate analysis of specific AFCs’ market performance. If not otherwise specified, a sample of AFCs included in each category is shown below.

2. AFC Total Asset Scenario Analysis

The CAAM forecasts the auto sales growth rate to be 5.4% in 2022. Accordingly, we set the following three scenarios for the growth rate and forecast the AFCs’ total asset in 2022, based on the correlation between auto sales and total asset.

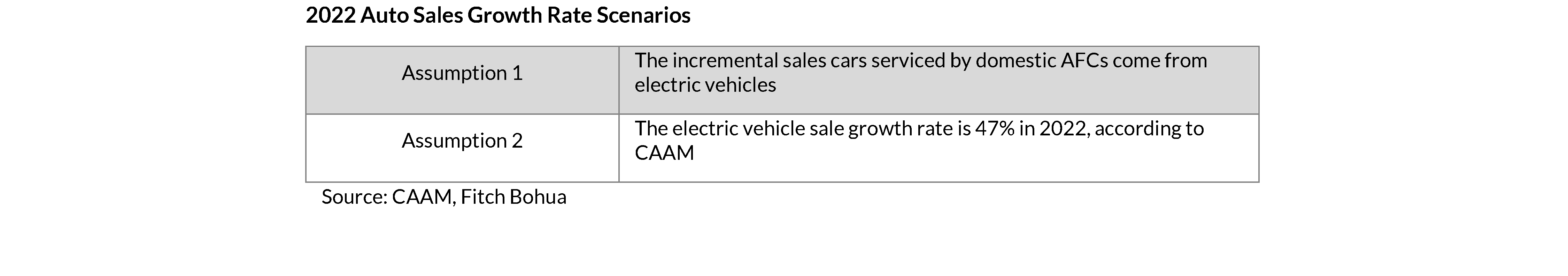

3. Domestic AFCs 2022 Market Share Forecast

The CAAM forecasts that electric vehicle sales will reach 5 million in 2022, a growth rate of 47% compared to 3.4 million in 2021. To calculate the domestic AFCs’ market share in 2022, we assume that the conventional fuel vehicles sales served by relevant AFCs will be the same as in 2021, and the sales of electric vehicles will be in line with the growth rate of the industry average forecast by CAAM. Finally, we get the domestic AFCs’ total asset market share.

4. AFC Net Interest Spread Forecast

The net interest spread is determined by a combination of the interest-earning asset yield and the interest-bearing liabilities cost. The interest-bearing liabilities cost is calculated based on the correlation between the interest-bearing liabilities cost and the first quarter 1-year Treasury yield since 2016. The interest-earning asset yield is closely correlated with the 1-year LPR, and is projected with reference to the LPR change in 2020, as the central bank improved the LPR formation mechanism in 2H19.

1 As of 1H21, there are 25 AFCs in China, of which 21 were set up by auto manufacturers.

2 Eleven sample AFCs include SAIC-GMAC, BMW, Mercedes -Ben, Dongfeng Nissan, Chang’an, GAC Sofinco, Toyota, Beijing Hyundai, Chery HuiYin, Ford, and Fortune.

Related reports

Low Growth of AFC Intensifies Industry Competition; Domestic AFCs Expand in Lower-Tier Markets

Strategic Synergy of Auto Finance Companies Gradually Deepen, Matthew’s Effect Prominently Protrude, Credit Size May Pace into a New-Round Growth

Interbank Market Auto Loan ABS Index 3Q21

Fitch Bohua Sector Outlook 2021: Automotive Manufacturers

Analysts

Frank Zhang

+86 10 5663 3827

frank.zhang@fitchbohua.com

Norman Sheng

+86 10 5663 3826

norman.sheng@fitchbohua.com

Disclaimer

This report is based on publicly available information or research that Fitch (China) Bohua Credit Ratings Limited ("Fitch Bohua") believes reliable. However, Fitch Bohua does not represent or warrant the accuracy or completeness of such information or materials. The opinions, assessments or forecasts contained in this report reflect the judgement and views of Fitch Bohua as at the date of this report, and at different time Fitch Bohua may issue reports that contain views or forecasts that differ with those in this report.

The information, opinions, estimates or forecasts contained in this report are for information purposes only and this report does not constitute a recommendation to any person or institution to buy, hold or sell any asset; this report does not comment on the reasonableness of market prices, the suitability of any investment, loan or security (including but not limited to any accounting and/or regulatory compliance or suitability) or the tax-exempt nature or taxability of amounts relating to any investment, loan or security. This report should not be relied upon by individuals or institutions as a factor in making investment decisions. Neither Fitch Bohua nor the relevant analysts accept any liability whatsoever for any loss or damage arising from the reliance on or use of this report.

The copyright of this report is owned by Fitch Bohua. Without Fitch Bohua’s written permission, no institution or individual may reproduce, copy, publish or quote this report in whole or in part. If Fitch Bohua's permission to quote or publish this report is obtained, it must be used within the scope of permission, with attribution to "Fitch (China) Bohua Credit Ratings Limited", and this report must not be quoted, abridged or modified in any way that is contrary to its original content. Fitch Bohua reserves all its right to claim.

The terms of this disclaimer are subject to revision and final interpretation by Fitch Bohua.

This report was prepared in Chinese. The English version is for reference only. In the event of any inconsistency between the two versions, the Chinese version shall prevail.